In our mission to champion informed choices, we have been fervently creating awareness about the dangers of the Old Pension Scheme (OPS).

OPS is the traditional pension scheme for government employees, through which they receive 50% of the last drawn salary as a pension. The catch here is that, unlike other pension schemes, they get a pension without any contribution to a pension fund during their years of service.

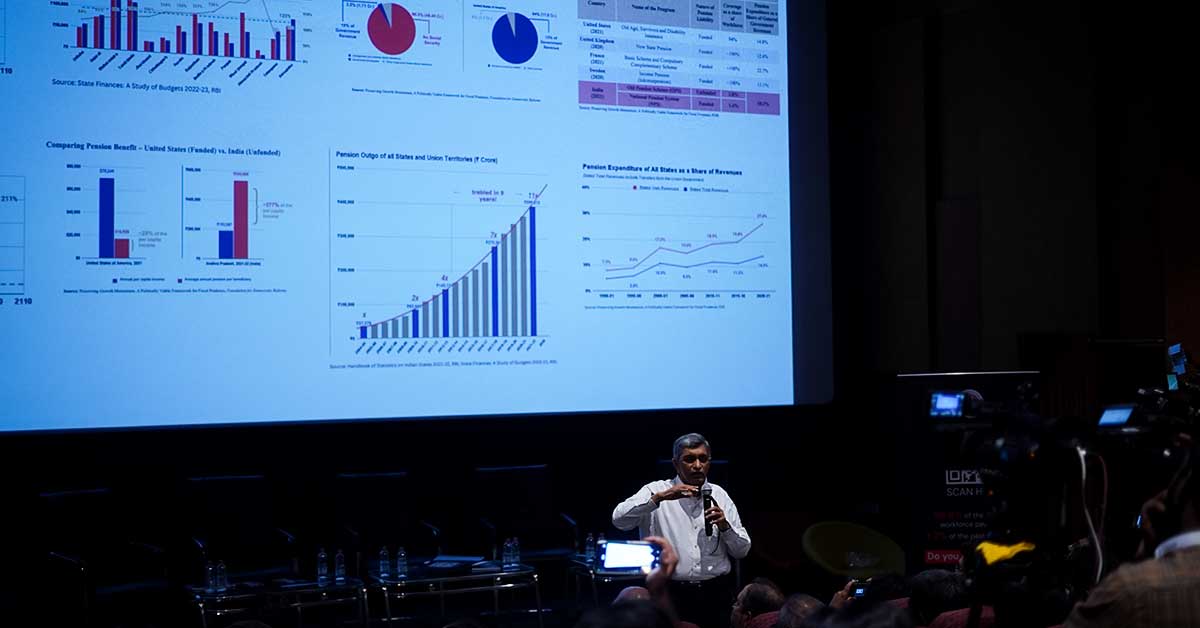

We began our journey in 1996 and have since become one of India's foremost think tanks and advocacy groups. Under the guidance of Dr. Jayaprakash Narayan, a distinguished former civil servant and MLA, we’ve contributed to shaping pivotal reforms across politics, governance, and public policy. We are dedicated to creating a brighter, more informed future for all.

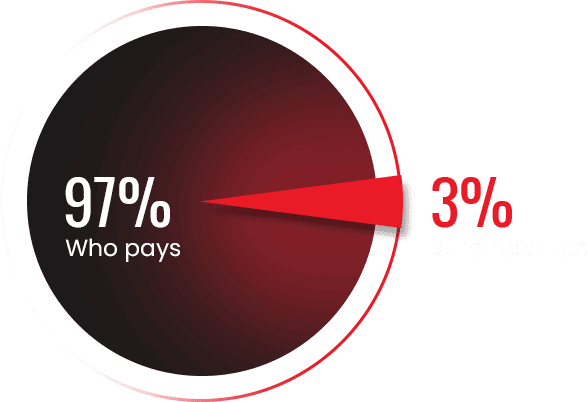

As governments struggle with increasingly tight budgets and financial constraints, OPS becomes a concern. Pension under OPS takes away a disproportionate amount of current tax revenue. It unfairly benefits a mere 3% of the workforce at the cost of the remaining 97%, which includes you.

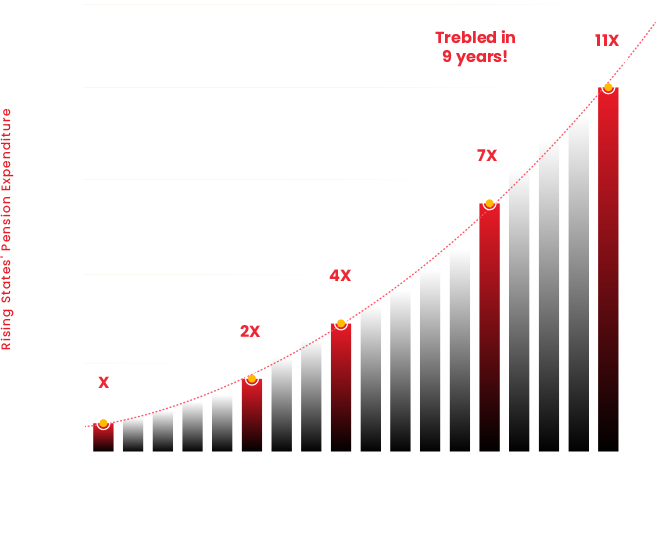

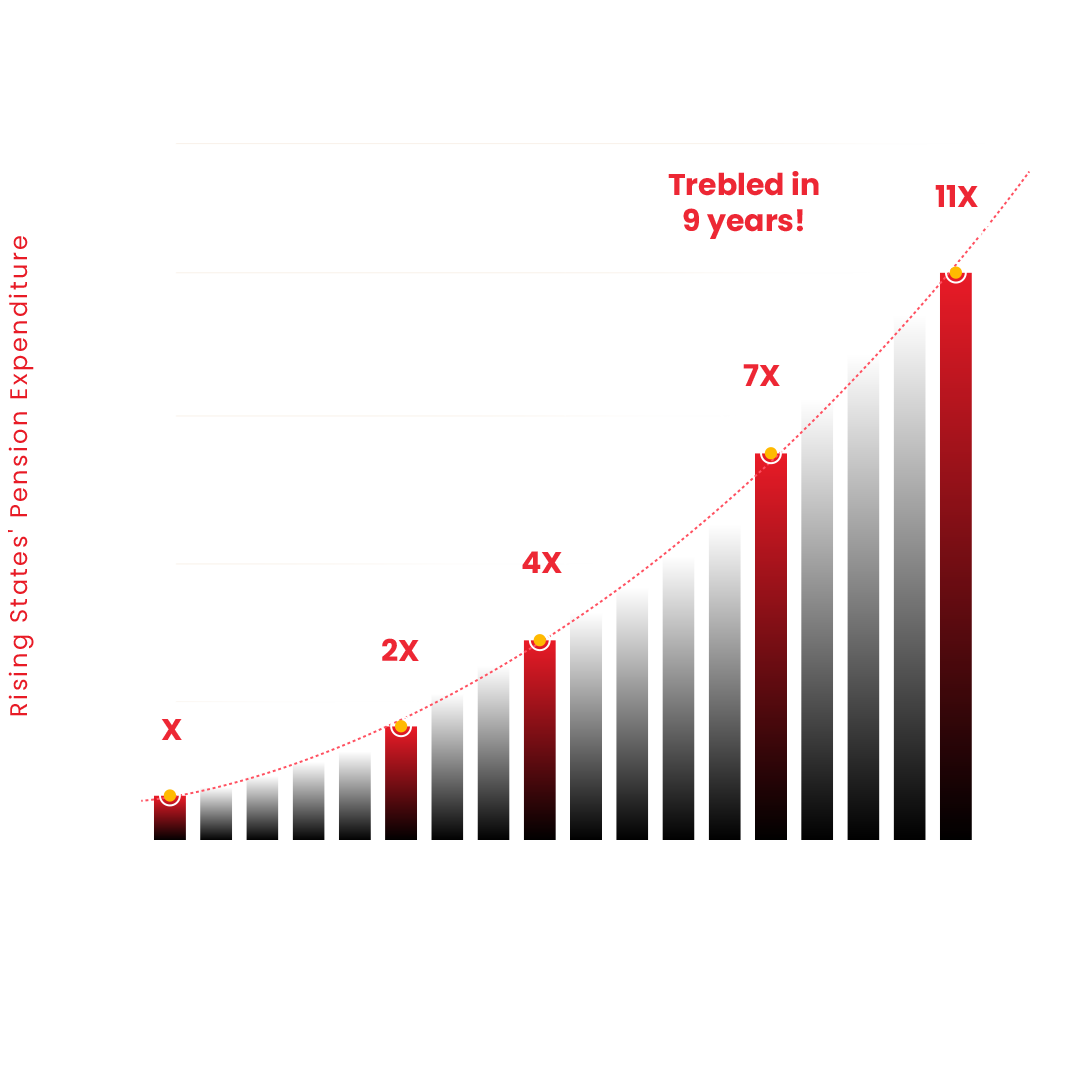

With people now living longer than before, pension burden will escalate further. This increases debt and deepens fiscal crisis.

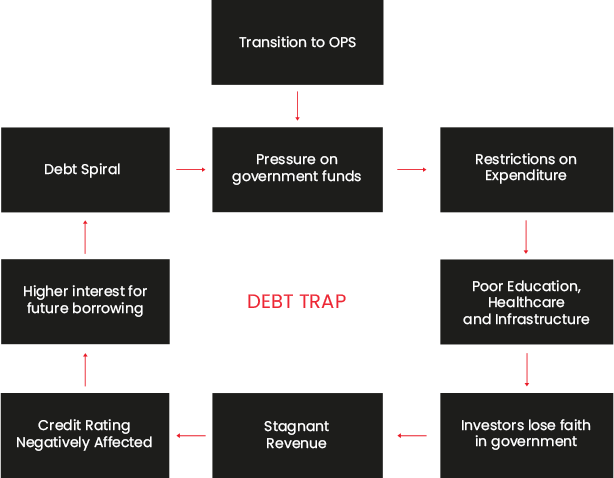

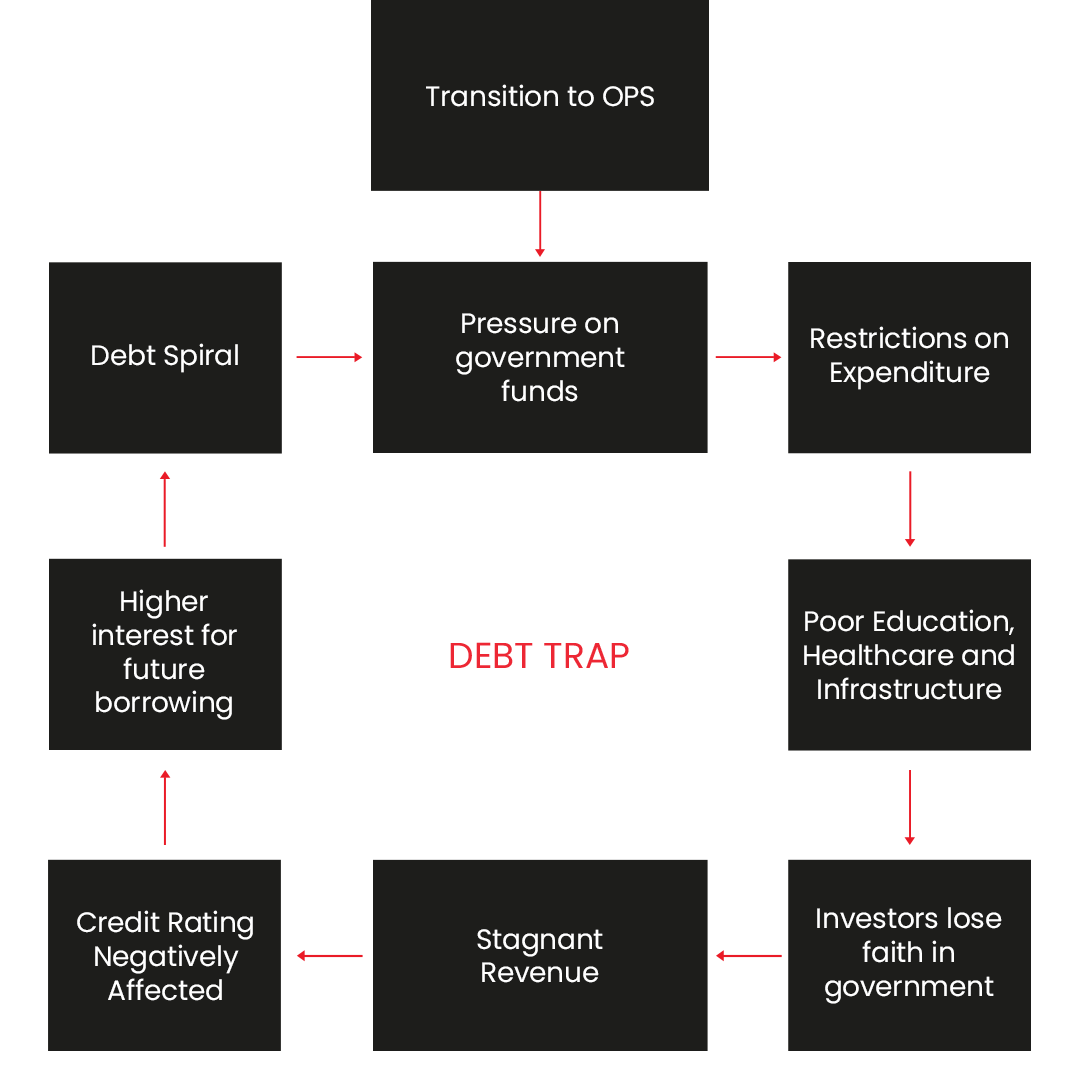

If the States continue to revert to OPS, salaries, pensions and interest payments on debt will far exceed the revenue, pushing the country into a debt trap and evenutally into a fiscal disaster.

The National Pension System (NPS), a defined contribution system introduced in 2004, presents a fiscally viable solution by mandating contributions from both employees and employers during active service, thus ensuring that there is no imposition of unsustainable burden on future generations or taxpayers. Not only does NPS promote fiscal prudence but it also provides social security for government employees through individual pension corpus, ensuring financial security for survivors. It is time to promote a contributory pension system for a sustainable and prosperous future.

Job Insecurity

Rising Tax Burdens

Soaring Food Prices

Diminished Service Quality

Limited Access to Even the Basic Amenities

No subsidies for Farmers

Poor Infrastructure

Financial Instability

Collapse of Education and Health Care

Job Insecurity

Rising Tax Burdens

Soaring Food Prices

Diminished Service Quality

Limited Access to Even the Basic Amenities

No subsidies for Farmers

Poor Infrastructure

Financial Instability

Collab of Education and Health Care

If a larger and larger share of our tax money goes to pay pensions for employees who worked in the past, we will be in a deep crisis, similar to Sri Lanka and Venezuela. The debt burden will rise, prices will soar, currency will fall further, and infrastructure and services will collapse.

India spends 18% of government revenue on pensions for 3.2% of the workforce.

Each income taxpayer bears a tax burden of ₹ 3,66,661 due to government employee pensions.

The governments allocate just ₹ 2350 for healthcare/person, but ₹ 4,11,560

for a government employee pension.

(Figures are based on annual spending)

The governments spend ₹4,11,560 / government employee on pensions but allocate only ₹ 11, 368 per capita for future investment by asset creation.

To prevent OPS from worsening our future, it's important to take action now.

The singular solution to this challenge is clear:

Say NO to OPS

Each income taxpayer bears a tax burden of over ₹3,66,661...

The governments allocate just ₹2350 for healthcare per...

The governments allocated only ₹11,368 per capita for...

India spends 18% of government revenue on pensions for 3.2%..

This is the original contribution towards Foundation for Democratic Reforms

Beware of any impersonators